Accurate revenue forecasting for businesses of all sizes is very important. If you’re looking to supercharge your revenue growth, Connectorly for Xero and Power BI with the Revenue Forecasting template is the right tool for you. This powerful solution can help you gain valuable insights, identify growth opportunities, and make data-driven decisions to optimize your business strategy.

Understanding the benefits of Connectorly for Xero and Power BI Revenue Forecasting

Connectorly for Xero and Power BI is a powerful tool that can provide you with a wide range of benefits for your business. Let’s take a closer look at some of these benefits:

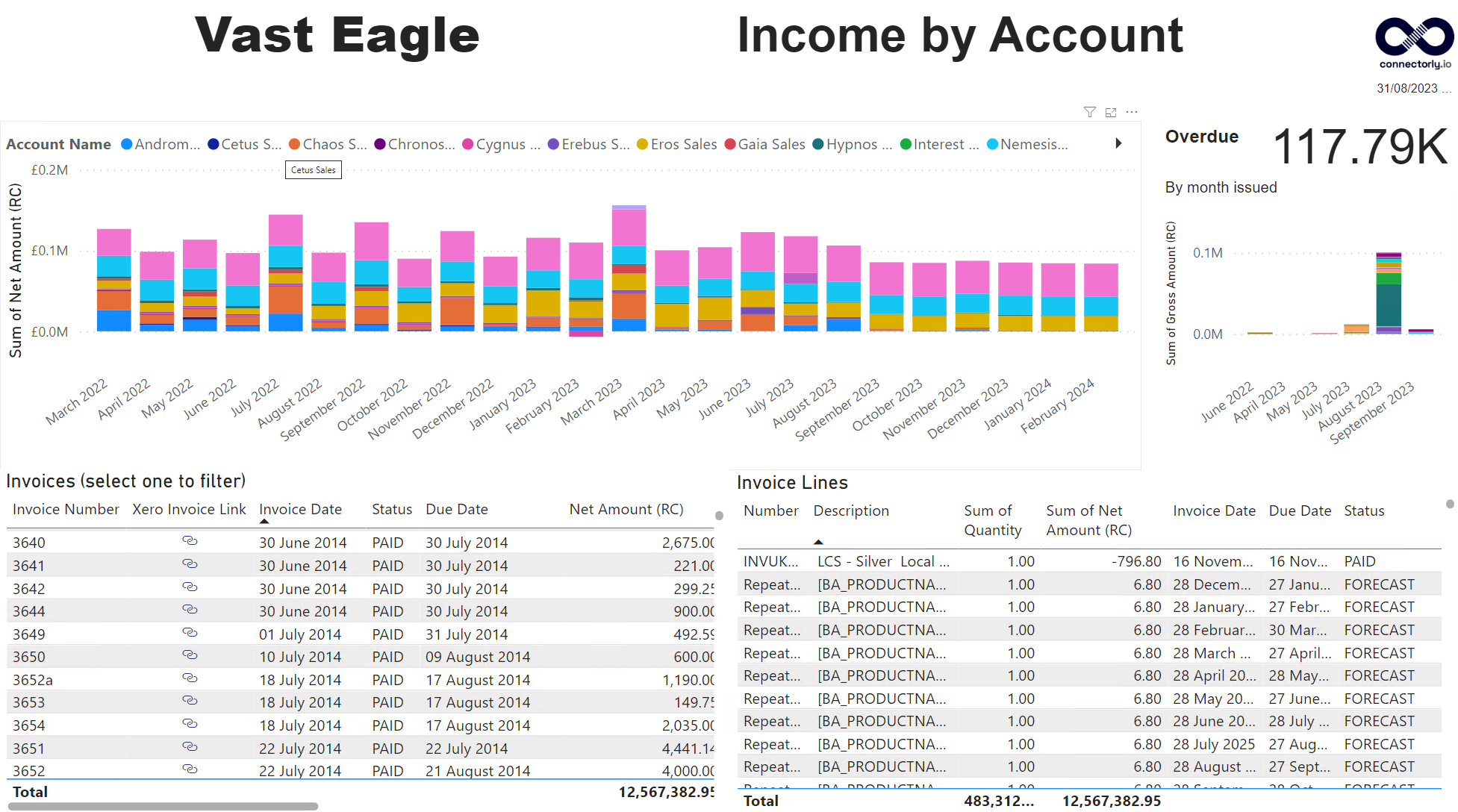

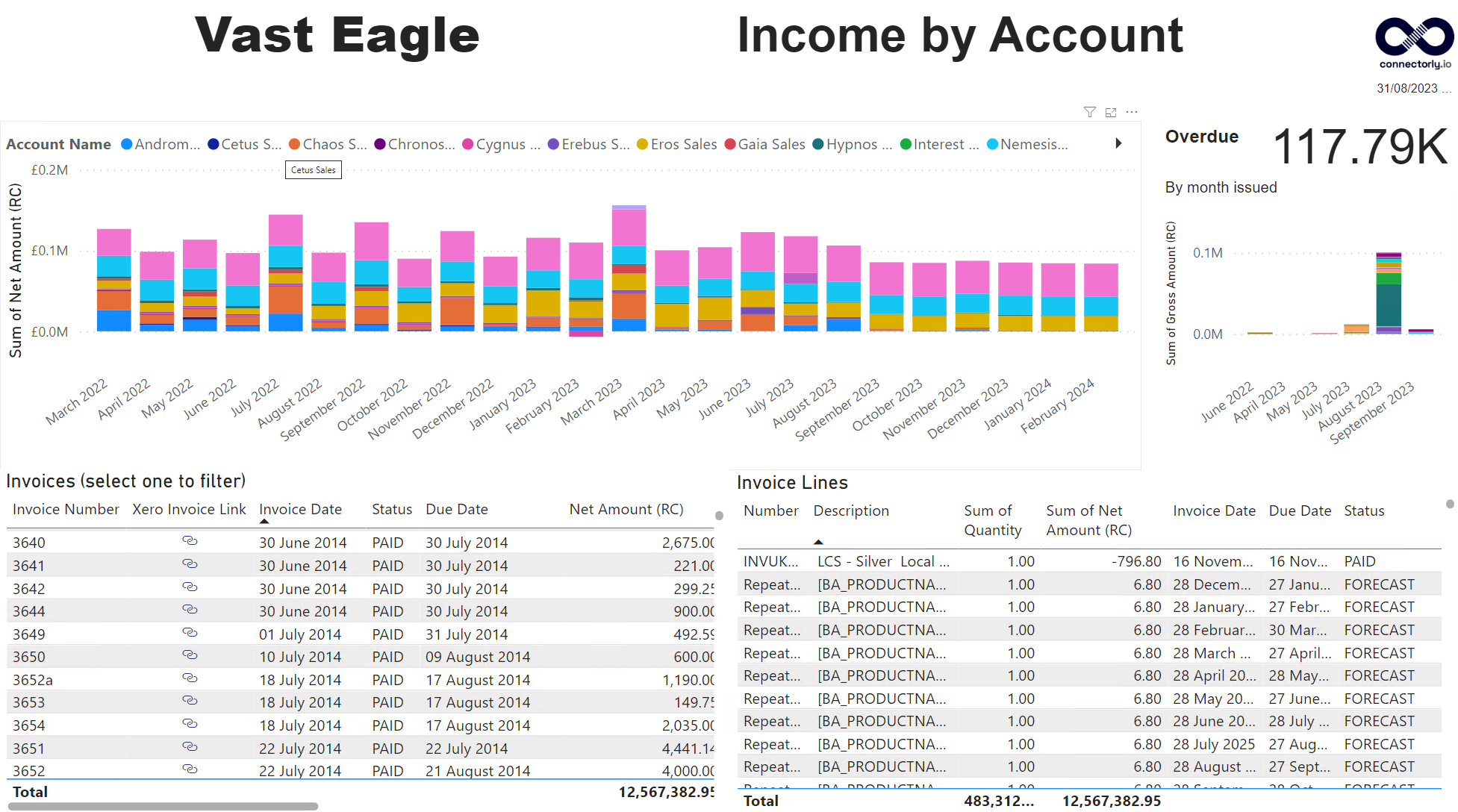

- Better Revenue Insights: With Connectorly for Xero and Power BI Revenue Forecasting, you can gain valuable insights into your revenue trends and patterns. By analysing your past revenue data and forecasting future trends, you can gain a better understanding of your company’s financial health and make informed decisions to maximize revenue growth.

- Identifying Growth Opportunities: One of the greatest advantages of using Connectorly for Xero and Power BI is its ability to help you identify growth opportunities. By analysing your sales data and identifying trends and patterns, you can identify areas where you can improve your revenue growth, such as by introducing new products or services, optimizing your pricing strategy, or expanding into new markets.

- Data-Driven Decision-Making: Connectorly for Xero and Power BI provides you with the data you need to make informed decisions about your business strategy. By having access to accurate revenue forecasts and insights, you can make data-driven decisions that are more likely to lead to success.

- Improved Financial Planning: Connectorly for Xero and Power BI can help you improve your financial planning by providing you with accurate revenue forecasts. This can help you allocate your resources more effectively, plan for future investments and expenses, and ensure that your business is financially stable and prepared for the future.

Setting up your Connectorly for Xero and Power BI

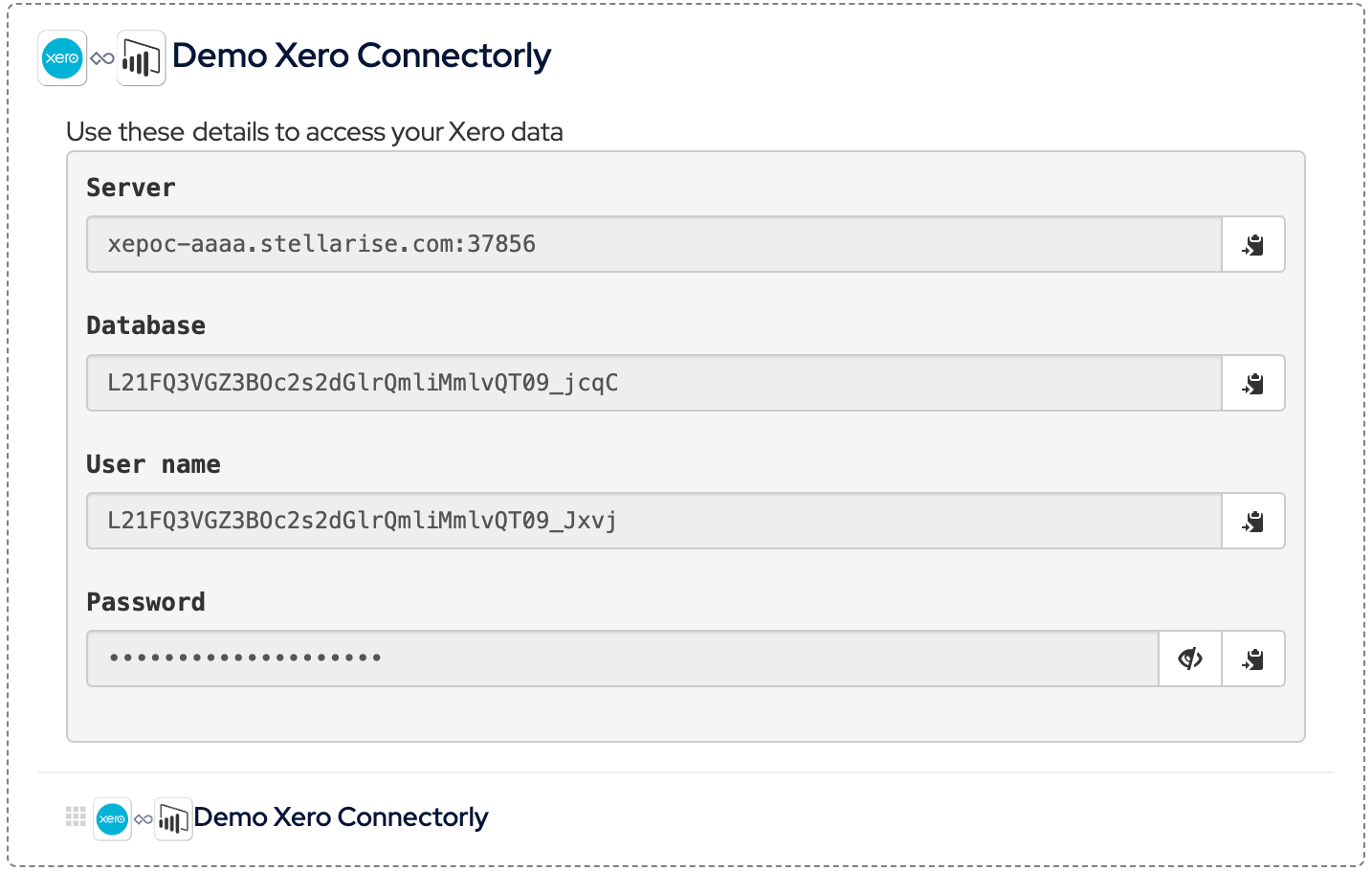

With just a few clicks you can easily set up your new Connectorly for Xero and Power BI on our platform.

Once you created your account with Connectorly, you can enjoy our integrations between your SaaS systems.

Create your Connectorly for Xero and Power BI free trial and connect to your Xero organisation.

Once you have connected our platform will create your Xero data model and start to collect your Xero data.

While you waiting for the process to finish you can download our Revenue Forecasting template.

Check your data in Power BI Desktop

Once Connectorly for Xero and Power BI has finished collecting your data and creating the data model you can easily check your data by opening our template in Power BI Desktop.

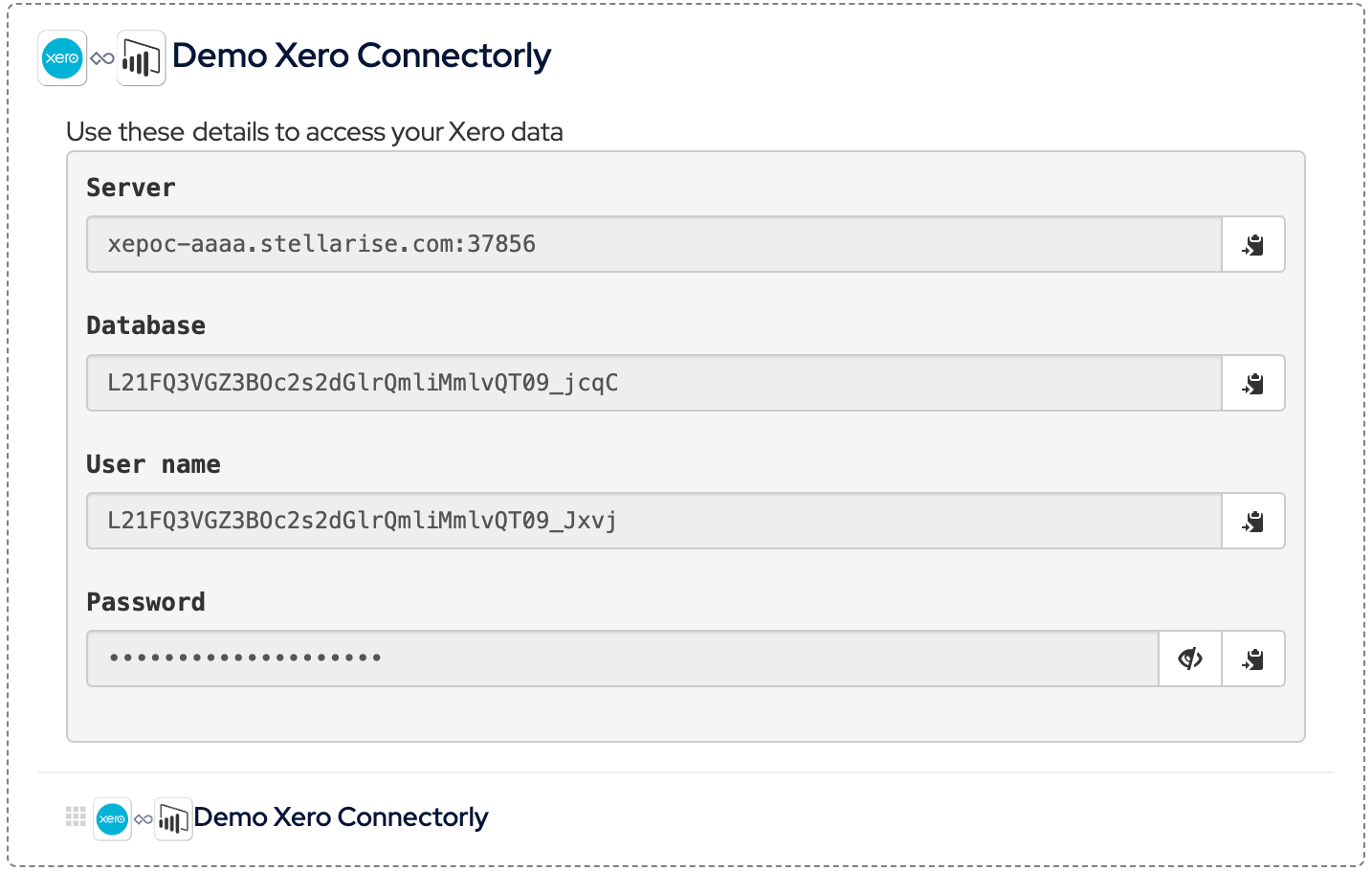

Copy your database details from our platform and once connected start to explore your countless options to get a better insight into your company’s financial health

.

Enhancing Revenue Growth with Connectorly Xero Power BI Revenue Forecasting

Identifying Areas for Improvement

One of the key features of Connectorly for Xero and Power BI Revenue Forecasting is its ability to provide valuable insights into your revenue trends. By analysing your historical financial data, the tool can help you identify areas for improvement in your revenue growth. For example, you may discover that certain products or services are generating more revenue than others, or that certain regions or customer segments are more profitable than others.

Once you have identified these areas for improvement, you can adjust your business strategy accordingly to focus on the areas that are driving the most revenue growth. This can help you optimize your business processes and make data-driven decisions to achieve even greater revenue growth.

Optimizing Pricing Strategies

Another way that Connectorly for Xero and Power BI Revenue Forecasting can help you enhance your revenue growth is by optimizing your pricing strategies. Your historical pricing data and revenue trends can help you identify the optimal price point for your products or services.

Aligning Sales and Marketing Efforts with Revenue Goals

Finally, Connectorly for Xero and Power BI Revenue Forecasting can help you align your sales and marketing efforts with your revenue goals. By providing you with accurate revenue forecasts, the tool can help you set realistic revenue targets for your sales and marketing teams.

With these revenue targets in mind, your teams can then focus their efforts on the areas that are driving the most revenue growth. This can help you optimize your sales and marketing strategies and achieve even greater revenue growth.